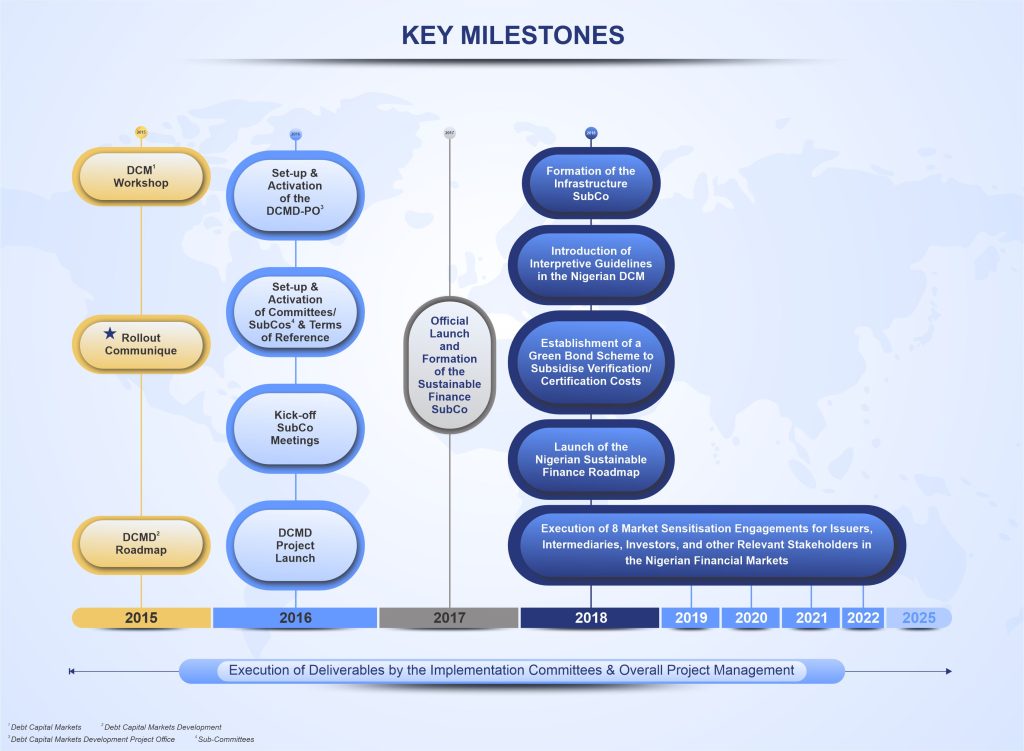

DCMD Project, in collaboration with the International Finance Corporation (IFC) and with the support of the Securities and Exchange Commission (SEC), organised the Nigerian Debt Capital Markets (DCM) Workshop on October 27 – 28, 2015, aimed at stimulating the growth of the Nigerian DCM. The Workshop, themed “The Nigerian Debt Capital Markets – Towards a Brighter Future”, was organised to harness the capacity and potential of the domestic DCM, with the aim of exchanging ideas for enhancing and deepening the Nigerian financial market. The Workshop, which was attended by domestic and international financial market experts and regulators, considered various challenges limiting the growth of the Nigerian DCM, brainstormed on the initiatives required for stimulating the markets’ development and arrived at key decisions that would energise the Nigerian DCM, thereby supporting the economic development of the nation.

The resolutions from the Workshop set the pace for the Nigerian DCM Transformation Roadmap for the Debt Capital Market Development (DCMD) Project.